May 2016 Newsletter

BE SMART WHEN LISTING YOUR REAL ESTATE FOR SALE

Statistics are out for Pinellas County Real Estate Activity, March 2016, thanks to the Pinellas Realtor Organization* and CEO David Bennett. This is a county-wide report; there will be individual communities that experience somewhat different models. Generally speaking the best news for a healthy real estate market, properly priced properties sell.

Statistics are out for Pinellas County Real Estate Activity, March 2016, thanks to the Pinellas Realtor Organization* and CEO David Bennett. This is a county-wide report; there will be individual communities that experience somewhat different models. Generally speaking the best news for a healthy real estate market, properly priced properties sell.

For Pinellas County as a whole, homes went under contract more quickly and closed faster for more money year-over-year for March. Closed sales for Single Family and Townhome/Condo combined for March 2016 was 2,069, up 1.9% from 2,030 in March 2015. Broken down, Single Family sales were up 18.7% and Townhome/Condo sales were down 2.2% year-over-year. The median sales price for March 2016 was $200K whereas March 2015 it was $175K. Active listings (inventory) are down all around from last year this time.

Last month Florida Realtors® added the Median Percent of Original List Price Received statistic… For Single Family, it was 95.9% in March 2016, up 1.8% from 94.2% in March 2015. Townhome/Condo was 94.5% in March 2016, up .07% from 93.8% in March 2015. Reminder, this is County-wide.

Summary Statistics March 2016 compared to March 2015:

- Closed Sales… Up 1.9%

- Paid in Cash… Down 10.4%

- New Pending Sales… Down 7.9%

- New Listings… Up 1.7%

- Pending Inventory… Up 1.8%

- Inventory (Active Listings) Combined Single Family Homes & Townhomes/Condos… Down 7.9%.

*Representing more than 6,000 members, the PINELLAS REALTOR® ORGANIZATION is one of the Tampa Bay area’s largest professional trade associations. The organization advances and promotes the real estate profession through professional development programs, government affairs, and political advocacy and maintains a high standard of conduct by real estate professionals through professional standards training and administration.

If you are a prospective seller you’ll likely interview a number of real estate professionals in your market to determine your best “fit”… i.e. the overall reputation, the expertise, the networks and marketing plan offered, the references, the service you expect and the hands on management of the program best suited to your specific goals.

You next major decision will be PRICING.

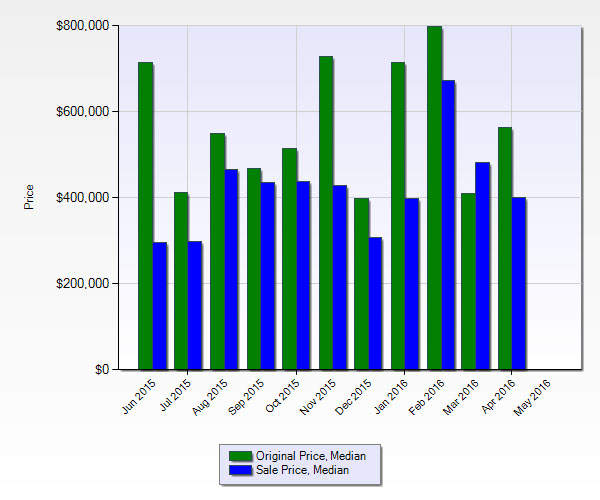

The following graphic was generated directly off our MLS Matrix system for St. Pete Beach, 33706. It shows the spread between the median ORIGINAL offering/list price and the median price where these properties actually sold. What must be factored into your pricing decision is time on the market, because it is proven today just as it was before we had computers, the longer a property sits the lower the sales price.

The take away is this, pricing a property for the most successful sale is not only a science, based on what actual statistics tell you, it is also an art that the professional Realtor develops over years of experience and intimate study of your home real estate market and the relative sales climate at any given time.

I just read a great article written by Joseph A. Rand, a managing partner of Better Homes and Gardens Real Estate, which was published in an on-line newsletter dated 5/1/2016 in the professional real estate journal, Inman.com . Here I’ve paraphrased and commented on his valuable discussion about the 6 BIG MISTAKES sellers make in pricing their property.

1. Biggest mistake, pricing to what has not sold rather than what WAS sold.

When I was a new Realtor the saying went like this, “Price a little high, and a little low…” given a stable market, you can successfully price a little higher than what just sold, but also price it lower than what is currently offered for sale, i.e. the competition.

In today’s world, the real estate market is quite transparent, and consumers have many sources available at their fingertips to educate themselves about current and historic market trends locally as well as globally, along with all specific sales data.

2. Overvaluing the amenities.

What is important to one owner may not be important to another, or even preferred, such as granite countertops and high end fixtures and appliances. Even a pool may be a drawback, perhaps for an out -of -town owner who doesn’t prefer the added maintenance and liability, or a family with an infant who are concerned about family safety.

3. Reflecting improvements you’ve made dollar for dollar in the list price for your home.

Although not a set rule, buyers may not appreciate the improvements you’ve made along the way as much as you did when you paid for them, especially if they’re a bit out-dated or used up. A car never brings the same price 5 minutes off the lot. I believe it’s safe to say, dollar for dollar return, a fresh coat of paint and/or colorful or pleasant manicured curb appeal is your best investment…after de-cluttering, de-personalizing the home as much as possible so that it appeals to the widest range of prospective buyers. They are not buying you along with the house.

4. Pricing with your next home purchase needs in mind.

Buyers won’t care what you need to net for your next purchase.

5. Pricing according to on line computer estimates, Zestimates, automated valuation models.

These sites are available everywhere, even on some agents’ websites (!), fun tools to “see where you are today”… But these are macro-level, at-a-glance unwarrantable valuations that no one, even the people who create them, believes to be accurate enough or substantive enough to be dependable indicators of where a property is properly placed on the market. A good buyer, one who will pay the price, will also seek professional guidance and expertise.

An example given by Mr. Rand:

www.inman.com/2015/02/23/have-a-problem-with-zestimate-more-avms-are-coming-your-way

“For homes with Zestimates of , say, $400K, only half those homes are going to sell inside a range of about $368K to $432K. The other half is worth more or less than that range.” What if an agent knocks on your door and suggests you list your home in a range of $368k to $432K, then adds he’s confident you have a 50% chance of selling it in that range….? That’s essentially what you get with an AVM.

6. Ignoring feedback and traffic indicators.

Really look at the listing to selling to time ratios when you price your property. AND once you have listed your property on the active market, stay engaged. Listen to what the market is telling you: listen to what buyers are saying and feedback from showing agents, watch the traffic patterns, on-site and on-line, keep up with what your neighboring competitors are doing, and find out what your prospective buyers bought instead of buying your property.

Your agent should be prepared, in writing, to help you make an informed decision about pricing your property. Then your agent will be kind, your agent will be understanding, and ultimately your agent will do his or her best job to continuously counsel you and to ensure you’re not still sitting in your home six months later, along with the other Un Solds.

I’m happy to provide any reader a 3 month snapshot, real time, of market statistics in our community. I’ll also provide a more detailed report containing a wealth of information on your community, current and recent statistics as well as real estate market trends in your area.

Further, I can provide an analysis of a specific property in relation to these statistics and trends, valuable information for assessing the proper market position of any residential property in the area…and for establishing the proper marketing plan if you’re ready to sell.

TIME IS MONEY. BE SMART, INTERVIEW, ASK QUESTIONS AND DISCUSS VIABLE GOALS. A REAL ESTATE AGENT’S PRIMARY GOAL IS HELPING YOU REACH YOURS.

If you’d like to receive a comprehensive, professional report to help you assess the viability of your goals in investing, selling, buying or remodeling a property, please contact me today.